Trading Tips from Some of The World’s Best Traders

Being a trader requires more than just self-studying and research. Most of us have heard that “experience is the best teacher of all” but that doesn’t mean that we have to experience it first hand just to learn something.

One way to do this effectively is to ask for tips and advice from experienced traders. This may be one of your friends or someone that has been around the trading arena longer than anyone else and is well renowned all over the world.

In the advent of the internet, searching for tips and advice is easier than it was back then when traders used to meet up along the streets of Wall Street exchanging valuable information about a certain stock or currency or any strategies that will benefit their fellow traders.

Here we will give you 5 of the best trading tips from the word’s best traders of all time.

“In life, you don’t fail if you get it wrong. In life, you fail if you stop”

Greg Secker

This speaks a lot for aspiring forex traders. Most forex traders stop within the 1st year of their forex trading journey. Some traders take their losses too seriously and they don’t have the mental capacity to take in that loss and use it to their advantage.

In all honesty, forex trading is not a walk in the park. As a new trader, losses are part of the game and it will aid you in forming your skills and trading habits to be consistently profitable given if you have the will to learn from your mistakes.

“The way to build long-term returns is through preservation of capital and home runs”

Stanley Druckenmiller

A trader’s position size depends on the trader’s risk tolerance, his/her confidence in trading knowledge, the size of the account and the volatility of the potential of the trade. By learning how to find your own balance and knowing how these factors will affect you, you can use all of these to your advantage.

“Unfortunately, the more complex the system, the greater the room for error.”

George Soros

In trading, most new traders think that they should learn hundreds or thousands of technical indicators to help them in their charting analysis. What happens mostly is the opposite. When using lots of indicators, it will only bring confusion to your decisions because not all indicators work best with one another. Also, having too many lines or what else you have in the chart will make it hard for any trader to read the chart itself.

As long as you have a good understanding of how the forex market works and having a good trading habit, that’s all you need to be consistently profitable.

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”

Warren Buffett

We all know who Warren Buffet is and how he started trading with more or less than a $100 account. At 11 years old he made his first investment buying three shares of Cities Service at $38 per share.

The price dropped to $27 but he held on tenaciously which is a well-renowned trait by Warren Buffet up to this day. He held on the stock until it reached $40 and sold his share at a small profit.

Warren Buffet regretted this decision when the Cities Service stock shot up to nearly $200 a share. Until then, Warren learned the art of “not being afraid” on being a little aggressive on trade ideas that he is confident about.

Besides, you won’t waste your time analyzing a data or a chart by getting only a pip or two from your trading set up right?

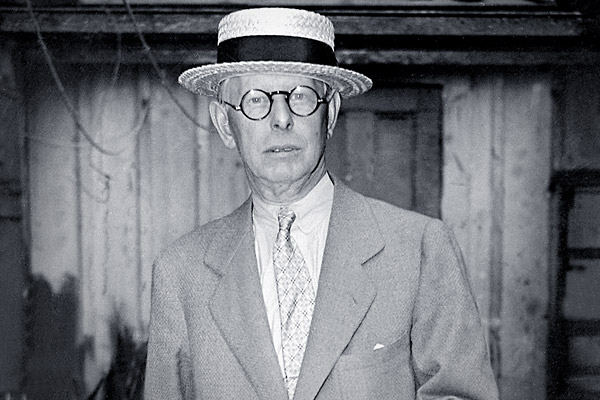

“No trading rules will deliver a profit of 100% of the time”

Jesse Livermore.

Like what we always say, losses are inevitable. Once you have losses, the best thing that you can do is to find a system that is profitable and compatible with your trading personality and setup. Once you find it and was able to put it to the test, stick to your trading plan no matter what happens or make any minor changes of things go wrong.

Always remember that forex trading has an endless learning environment. As long as you are open for new trading ideas that you think will benefit you, you can add that to your trading plan and make adjustments and stick to it.

Don’t forget to follow and subscribe for more updates about market trends, analysis, forex news, strategies and more!

Do you want to learn more about forex trading? Sign up now on our FREE forex webinar and reserve your FREE seats while it still lasts!

Risk Disclaimer:

Information on this page is solely for educational purposes only and is not in any way a recommendation to buy or sell certain assets. You should do your thorough research before investing in any type of asset. Learn to trade does not fully guarantee that this information is free from errors or misstatements. It also does not ensure that the information is completely timely. Investing in the Foreign Exchange Market involves a great deal of risk, resulting in the loss of a portion or your full investment. All risks, losses, and costs associated with investing, including total loss of principal and emotional distress, are your responsibility.