-

Despite the rising conflicts of U.K and EU and the deadlock of post-Brexit talks which will be resumed next week, the British Pound continues to surge with its 5-month highs against the U.S. dollar and is likely to add gains as GBP/USD rose 0.15% to $1.305sh.

Next week August, 18, 2020, U.K. ’s chief Brexit Negotiator David Frost would expand more on a range of measures including regulator standards, fisheries, and security policy. However, the standoff seems difficult to resolve as the U.K. would not come in to terms on its sovereignty, over its laws, courts or fishing waters.

Analysts however seems to deemphasize any deal making at the upcoming round of talks next week as U.K. seems to adopt World Trade Organization terms with the EU.

“As the trade talks have made no progress so far, it seems increasingly unlikely that an agreement will be reached by the end of the year,” Commerzbank (DE:CBKG) said. “Without such an agreement, trade would then be conducted according to WTO rules from next year onwards, which would be a bitter blow for both sides in real economic terms, but above all for the British economy, for which the EU is by far the largest trading partner.”

Despite all this, the probability of a no-deal Brexit seems to have not burdened the pound as the U.S dollar continues it slide in the face of internal issues of U.S.A.’s ceased unemployment benefit issues and other economical strains.

GBP/USD would likely reach to $1.32 nearing the end of year 2020 and might hit a high of $1.39 next year as conjectured by Commerzbank.

TECHNICAL OUTLOOK

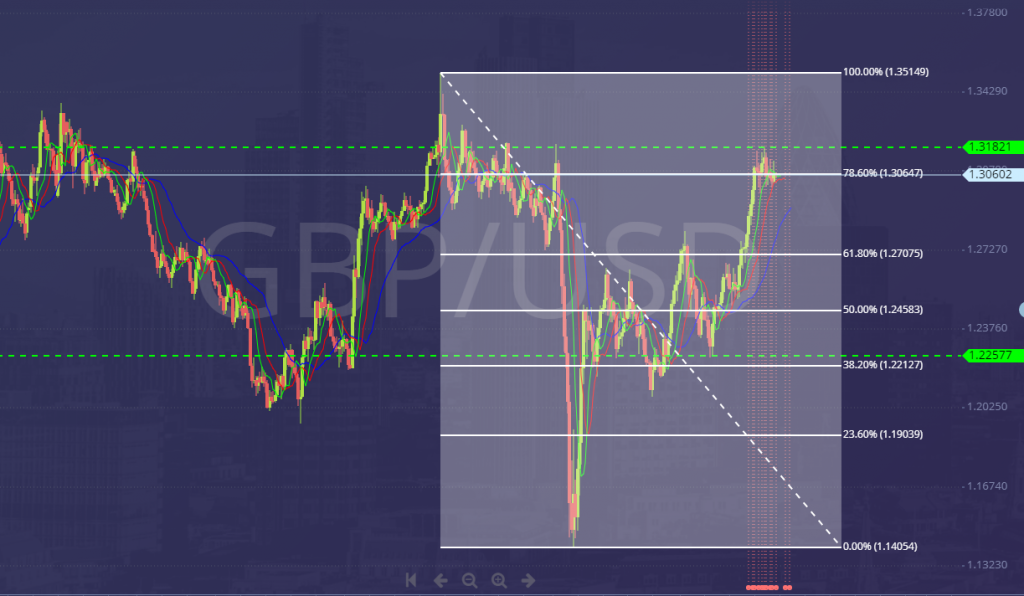

As we see in the daily charts of GBP/USD, the currency pair is nearing its resistance at 1.318sh once again. The prices for this week also seem to glide in the 78.60% retracement signaling a probable bullish surge at the start of next week. As forecasted by Commerzbank of the pair to reach 1.32 by the end of the year, will it finally break out next week at the 1.318sh resistance and reach its new highs?

Don’t forget to follow and subscribe Learn To Trade Philippines for more daily updates on news, trends, analysis, facts and more on FOREX TRADING!

To learn more about forex trading and how to profit in this financial market, sign up now and reserve your FREE seats while it still lasts!

Risk Disclaimer:

Information on this page are solely for educational purposes only and is not in any way a recommendation to buy or sell certain assets. You should do your own thorough research before investing in any type of asset. Learn to Trade does not fully guarantee that this information is free from errors or misstatements. It also does not guarantee that the information is completely timely. Investing in the Foreign Exchange Market involves a great deal of risk which may result in the loss of a portion or your full investment. All risks, losses and costs associated with investing, including total loss of principal and emotional distress, are your responsibility.

By bsuper

| No Comments