-

25November, 2020

On Wednesday morning, the dollar nursed losses against a basket of major currencies as progress in the COVID-19 vaccines are on a positive mood and investors started to look for riskier currencies.

The optimism from the investors is due to the possibility of the vaccine becoming available soon worldwide and economic recovery in many countries will be in grasp.

The U.S Dollar Index edged down 0.17% to 92.067 by 11:55 PM ET (3:55 AM GMT).

With AstaZeneca reporting positive results for their candidates last Monday, other companies such as Pfizer and Moderna Inc also reported their positive results over the past two weeks, thus increasing the mood of having a vaccine soon.

The U.S. Dollars declines are also likely to continue further because U.S. President-elect Joe Biden’s next secretary relieved two big uncertainties for investors.

“Rising yields may lend the dollar some support, but the overall direction is it will head lower,” Said Junichi Ishikawa, senior foreign exchange strategist at IG Securities in Tokyo.

“The trend has shifted to favor risk assets. Yellen will team up with the Fed and support the economy. U.S. rates will remain low for a long time.”

Research suggesting that a COVID-19 vaccine availability before the end of the year has supported U.S. stocks and edged to record new highs and reduce the appeal of holding the dollar as a safe-haven currency.

Risk-appetite also increased as incumbent Donald Trump cooperates with U.S. President-elec Joe Biden with the transition although reluctant and still continuing with his legal charges.

Technical Outlook

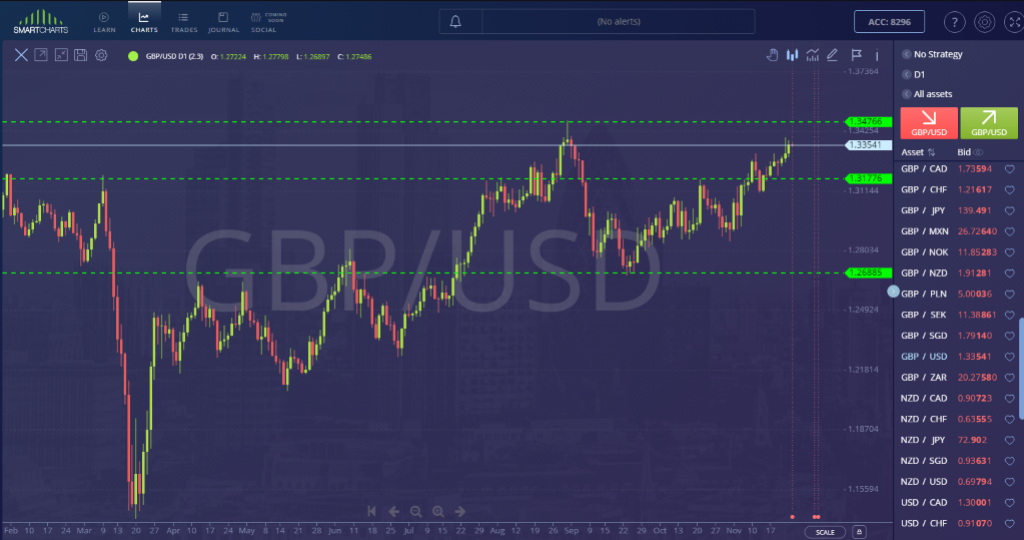

In the daily charts of GBP/USD, the pair edged higher early Wednesday morning in Asia session.

As what we can see in the chart, the pair is still being support by the resistance level at 1.31776. Due to the weakening of the dollar and the optimism in the COVID-19 vaccine and Brexit deals, we may expect the sterling to test the resistance level at 1.34766 in the coming days. Possible breakout from this resistance level will record a new high from the sterling for the year.

However, if the price will fall from, we may expect the pair the re-test the support level at 1.31776 before falling further.

If the price will break down from the support level at 1.31776. we may expect the pair to fall further and test the support level at 1.26885.

Don’t forget to follow and subscribe for more updates about market trends, analysis, forex news, strategies and more!

Do you want to learn more about forex trading? Sign up now on our FREE forex webinar and reserve your FREE seats while it still lasts!

Risk Disclaimer:

Information on this page is solely for educational purposes only and is not in any way a recommendation to buy or sell certain assets. You should do your thorough research before investing in any type of asset. Learn to trade does not fully guarantee that this information is free from errors or misstatements. It also does not ensure that the information is completely timely. Investing in the Foreign Exchange Market involves a great deal of risk, resulting in the loss of a portion or your full investment. All risks, losses, and costs associated with investing, including total loss of principal and emotional distress, are your responsibility.

By bsuper

| No Comments