Trump’s impact on US GDP, and why the Brazilian real is the new Turkish lira

US stock index futures have turned lower even though the second reading of Q2 GDP was revised higher to 4.2% from 4% initially. Personal consumption slipped a little, to 3.8% from 4%, however private investment and trade helped to boost the overall GDP report.

Trump’s trade tariffs pay dividends already

The impact of government policies from the Trump administration can be seen in this data. Firstly, imports fell quite sharply from 3% in Q1 to -0.4% in Q2, which may have been as a result of the trade tariffs on Chinese and EU goods imposed by Trump’s team in recent months. Trump is likely to claim victory in the trade war since exports also picked up sharply, rising by 9.1%, from a 3.6% increase in Q1. Government consumption also rose to 2.3% from 1.5% in Q1, which may not please all sections of the Republican party, however, higher government spending is to be expected in the months leading up to the Mid-Term elections in November, and we could see US government spending retreat into year end.

Why good news is bad news for US stocks

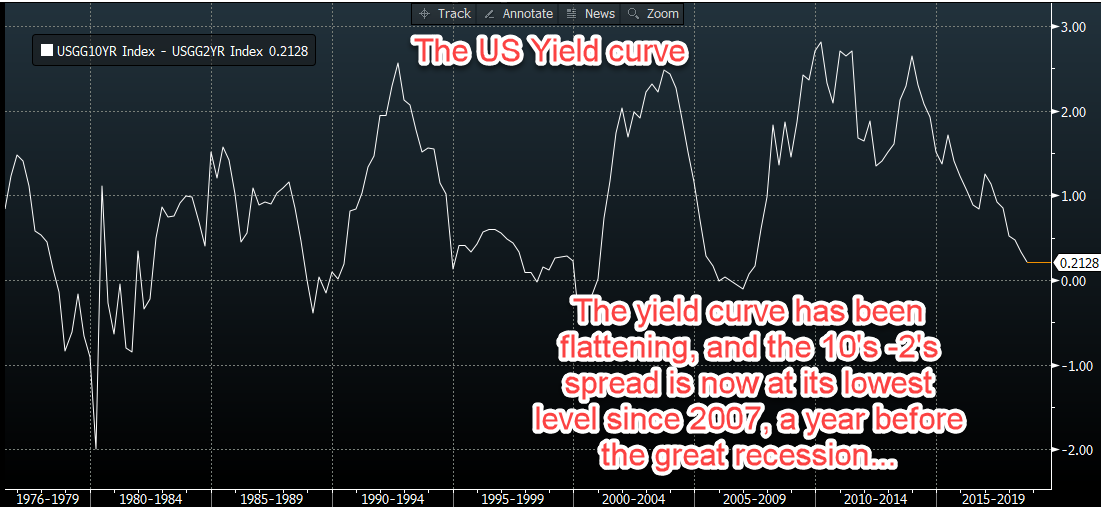

Overall, this GDP report suggests that the US is experiencing a solid level of growth and is expanding at a rate well above its G7 peers, which should be supportive of stocks, weigh on bond prices and should be dollar positive as it supports further rate hikes from the Federal Reserve. However, the impact on stocks could be short-lived for a couple of reasons. Firstly, after making fresh record highs earlier this week, US stocks are looking richly valued, which could be off-putting for longer term investors. Secondly, a strong economy now could mean that the Federal Reserve needs to tighten interest rates at a faster than expected pace, which could hasten a slowdown in the US economy down the road. This is reflected in the flattening yield curve in the US, which is at an 11-year low, as you can see in chart 1 below. Thus, good economic news can be bad news for US equity investors right now.

Chart 1:

Source: Capital Index and Bloomberg

Lula is no joke for the Brazilian real

Elsewhere, the Brazilian real touched a record low versus the USD on Wednesday as emerging market currencies suffered another wave of selling. The Turkish lira has once again declined more than 2.5% in the past 24 hours as the row with America over the imprisonment of pastor Andrew Brunson intensifies, and after a wave of downgrades for Turkish banks, which is a domino effect from a collapsing currency.

Brazil, the new Turkey?

The emerging market FX space has been impacted by the prospect of higher interest rates in the US and a stronger US dollar, however there are also domestic factors that are making some emerging market currencies particularly unattractive at the moment, for example in Turkey and now in Brazil. The market is bracing itself for an October election battle that has seen former President Lula, who had previously been imprisoned, experience a surge in support after he called a joint venture between Boeing and Embraer illegal. Political uncertainty has meant that in excess of $30bn of deals, M&A, IPOs and bond sales are on hold until after the election, which is also weighing on the currency. At this stage it is hard to see how the real can stage a meaningful recovery with the election risk on the horizon and the threat of a socialist president taking control, especially since the problems experienced by Venezuela are being reported on a daily basis. Thus, we could see further BRL weakness, with USD/BRL potentially breaking fresh record territory above 4.20 in the coming days.

Brexit delays, of course there are Brexit delays…

The pound has also backed away from earlier highs after news reports that the UK and the EU are dropping their October deadline to reach a Brexit deal and instead have pushed out the deadline day to mid-November. We doubt a deal will be hashed out by then, or even in 2018, we expect a deal to be reached, if one is to be reached at all, much closer to the UK’s official Brexit deadline of 31st March 2019, with a lengthened period of transition to get everything organised. This delay actually makes a lengthy transition period more likely, which in theory should be pound positive; however, it also makes a leadership challenge to oust Theresa May more likely, which is pound negative and the reason why the pound has come under some selling pressure in the last few hours.

GBP/USD also faces tough trend line resistance at 1.2875, which could be thwarting the bulls as we move to the later stages of this week. However, forgive us if we fail to get excited by the pound. The fact that it hasn’t dropped off a cliff on the back of the “delay” to Brexit negotiations is not a sign that investors are all short the pound. Instead, it suggests a pause in a fairly dead August FX market. We continue to think that a break back above $1.30 will be tough to achieve in the next 1-2 weeks, and remain unenthused by the pound overall.